Anti-Money Laundering (AML) regulations pose a persistent challenge for Irish accountants. Yet, amidst this regulatory burden, our mission at AML HQ is clear: to alleviate the complexities of compliance with our simplified AML solution.

In our last blog, we discussed the essentials of AML risk assessments and delved into both business and client risk assessments. We covered the assessment structure and the required risk categories and hopefully provided a good introduction to help understand your obligations.

At AML HQ, we have always provided clients with online risk assessment templates. Although straightforward, many of our clients still find it a challenging and time consuming task. It is for this reason that we started to create intelligent risk assessments, as a smarter and more efficient approach to conducting risk assessments.

Let's further consider the problem. When an Accountant sits down to complete their annual business risk assessment, their starting point is typically a 'copy and paste' of last year's assessment, or a blank template. It can be difficult to know what level of detail is required; what risks to highlight, and how to satisfy external scrutiny.

With our new concept of intelligent risk assessments, our approach is to provide supportive suggestions throughout the risk assessment process. We provide suggestive text and draft risk summaries based on real-time data from within your AML client database.

In April, we released the intelligent Business Risk Assessment and we are now moving on to the Client Risk Assessments.

Intelligent Business Risk Assessment

The Business Risk assessment is an important part of a practices AML framework. Along with the AML Policies and Procedures document, it is one of the first documents requested by professional bodies and therefore is your first opportunity to highlight how seriously you take your AML obligations and how well-organised you are as a practice.

The assessment is auto-populated with information from your AML HQ account and client base:

.png?width=740&height=438&name=Business%20Risk%20Assessment%20%20(1239%20x%20734%20px).png) If you answer a question that leads to a risk being identified, the intelligent assessment

If you answer a question that leads to a risk being identified, the intelligent assessment

provides suggestive text to help you evidence that you understand the risk and that you have mitigating actions within your AML Policies and Procedures. You are of course able to add further detail and context.

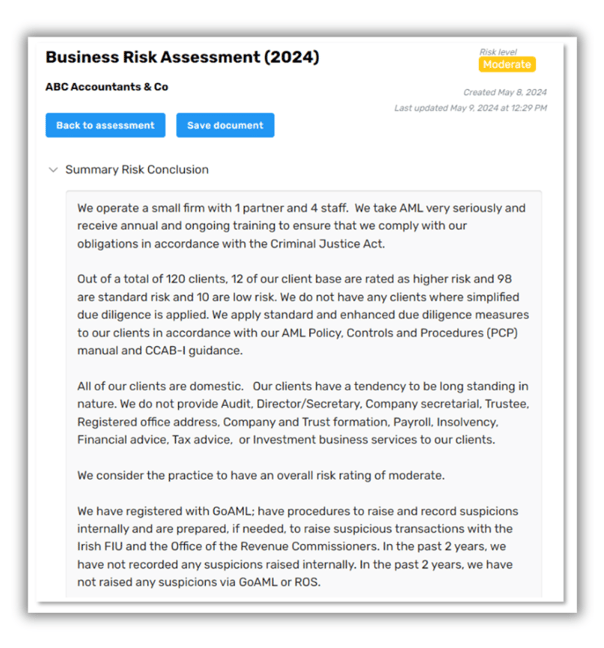

A risk summary is automatically generated based on your answers. When approved, the risk assessment is added to the front page of the Business Risk Assessment. This quickly provides external reviewers with a concise and well-formed profile of your business. It highlights your size, professionalism, and risk profile and is a first impression of how organised you are from an AML perspective.

A risk summary is automatically generated based on your answers. When approved, the risk assessment is added to the front page of the Business Risk Assessment. This quickly provides external reviewers with a concise and well-formed profile of your business. It highlights your size, professionalism, and risk profile and is a first impression of how organised you are from an AML perspective.

Brilliant But Simple Software

At AML HQ, we pride ourselves on offering brilliant but simple AML compliance software that gets you inspection-ready. Our all-in-one solution is tailored to meet the needs of sole practitioners and SME practices, encompassing AML client files, risk assessments, PCP templates, staff training, and identity verification tools.

For a streamlined approach to AML compliance, look no further than AML HQ. Schedule a call with our team today to discover how our secure portal can address all your AML obligations, allowing you to achieve compliance in less than an hour. Together, let's simplify AML compliance and focus on the exceptional aspects of your practice.

Compliance Made Easy